Blog/ Litigation Stats

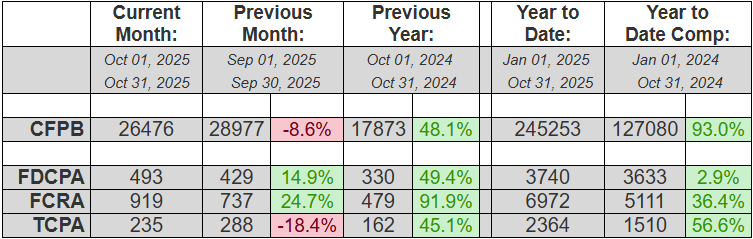

Quick analysis: TCPA & CFPB Complaints Down, FDCPA & FCRA Complaints Up for October

In a sign of the ongoing volatility of consumer complaints, TCPA (-18.4%) and CFPB (-8.6%) complaints were both down last month, after having been on a bit of a tear all year (+56.6% and +93% YTD, respectively). Meanwhile FDCPA (+14.9%) and FCRA (+24.7%) complaints were both up for the month and also for the year (+2.9% and +36.4% YTD, respectively). So everything is up YTD and it looks like it may end the year that way, unless FDCPA suits take a significant hit in Nov & Dec.

In other news, putative class actions represented 3.4% of FDCPA, 72.8%(!) of TCPA and 1.3% of FCRA lawsuits filed last month. TCPA class actions are still extraordinarily high, historically speaking. About 39% of all plaintiffs who filed suit last month had filed at least once before. And finally, South Florida attorney Gerald Lane (from The Law Offices of Jibrael S. Hindi) continued for a ninth straight month to represent both the most consumers in October (74) as well as YTD (664).

Complaint Statistics:

26476 consumers filed CFPB complaints, and about 1280 consumers filed lawsuits under consumer statutes from Oct 01, 2025 to Oct 31, 2025.

- 26476 CFPB Complaints

- 493 FDCPA, 17 Class Action (3.4%)

- 235 TCPA, 171 Class Action (72.8%)

- 919 FCRA, 12 Class Action (1.3%)

Litigation Summary (scroll down for CFPB data):

- Of those cases, there were about 1280 unique plaintiffs (including multiple plaintiffs in one suit).

- Of those plaintiffs, about 493, or (39%), had sued under consumer statutes before.

- Combined, those plaintiffs have filed about 11196 lawsuits since 2001

- Actions were filed in 170 different US District Court branches.

- About 725 different collection firms and creditors were sued.

The top courts where lawsuits were filed:

- 77 Lawsuits: Georgia Northern District Court – Atlanta

- 70 Lawsuits: California Central District Court – Western Division – Los Angeles

- 63 Lawsuits: Illinois Northern District Court – Chicago

- 46 Lawsuits: Florida Middle District Court – Tampa

- 37 Lawsuits: California Central District Court – Southern Division – Santa Ana

- 33 Lawsuits: Florida Southern District Court – Fort Lauderdale

- 31 Lawsuits: California Southern District Court – San Diego

- 30 Lawsuits: California Central District Court – Eastern Division – Riverside

- 28 Lawsuits: California Eastern District Court – Sacramento

- 27 Lawsuits: Florida Southern District Court – Miami

The most active consumer attorneys were:

- Representing 74 Consumers: GERALD DONALD LANE

- Representing 63 Consumers: JOSHUA BRANDON SWIGART

- Representing 62 Consumers: DANIEL GUINN SHAY

- Representing 61 Consumers: KATHERINE ANNE TUOHY

- Representing 17 Consumers: JENNA DAKROUB

- Representing 16 Consumers: OCTAVIO GOMEZ

- Representing 15 Consumers: ANGELA YU

Statistics Year to Date:

11329 total lawsuits for 2025, including:

- 3740 FDCPA

- 6972 FCRA

- 2364 TCPA

Number of Unique Plaintiffs for 2025: 9627 (including multiple plaintiffs in one suit)

The most active consumer attorneys of the year:

- Representing 664 Consumers: GERALD DONALD LANE

- Representing 225 Consumers: ANTHONY PARONICH

- Representing 223 Consumers: ZANE CHARLES HEDAYA

- Representing 181 Consumers: OCTAVIO GOMEZ

- Representing 179 Consumers: FAARIS KAMAL UDDIN

- Representing 112 Consumers: JONATHAN ALEXANDER HEEPS

- Representing 112 Consumers: DAVID J PHILIPPS

- Representing 104 Consumers: MARK A CAREY

——————————————————————————————————-

CFPB Complaint Statistics:

There were 26476 complaints filed against debt collectors from Oct 01, 2025 to Oct 31, 2025.

Total number of debt collectors complained about: 1122

The types of debt behind the complaints were:

- 15067 I do not know (57%)

- 5184 Other debt (20%)

- 3009 Credit card debt (11%)

- 871 Rental debt (3%)

- 808 Telecommunications debt (3%)

- 664 Medical debt (3%)

- 483 Auto debt (2%)

- 204 Payday loan debt (1%)

- 66 Federal student loan debt (0%)

- 61 Private student loan debt (0%)

- 59 Mortgage debt (0%)

Here is a breakdown of complaints:

- 8811 Attempts to collect debt not owed (33%)

- 6520 Took or threatened to take negative or legal action (25%)

- 6260 Written notification about debt (24%)

- 3622 False statements or representation (14%)

- 695 Communication tactics (3%)

- 337 Electronic communications (1%)

- 231 Threatened to contact someone or share information improperly (1%)

The top five subissues were:

- 5960 Threatened or suggested your credit would be damaged (23%)

- 4925 Debt is not yours (19%)

- 3615 Notification didnt disclose it was an attempt to collect a debt (14%)

- 3461 Attempted to collect wrong amount (13%)

- 3038 Debt was result of identity theft (11%)

The top states complaints were filed from are:

- 4334 Complaints: TX

- 2816 Complaints: CA

- 2793 Complaints: FL

- 2218 Complaints: GA

- 1092 Complaints: NC

- 1021 Complaints: IL

- 981 Complaints: VA

- 909 Complaints: NY

- 906 Complaints: PA

- 828 Complaints: AZ

The status of the month’s complaints are as follows:

- 14266 Closed with explanation (54%)

- 8694 In progress (33%)

- 2967 Closed with non-monetary relief (11%)

- 527 Untimely response (2%)

- 22 Closed with monetary relief (0%)

This includes 25769 (97%) timely responses to complaints, and 707 (3%) untimely responses.

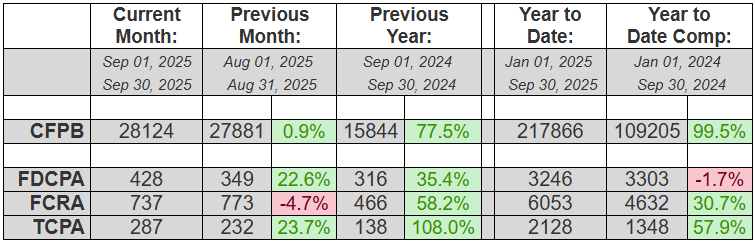

Quick analysis: TCPA, FDCPA way up over last month, FCRA down a bit.

September 2025 saw TCPA and FDCPA litigation spike by double digits (+23.7& and +22.6% respectively) while FCRA litigation ticked down a bit (-4.7%).

Year-to-date, FDCPA is closing the gap and trending to possibly surpass last year’s number. Over the last six months, FDCPA has been hovering in the range of -9% down to -5% down over 2024. In September, that gap dropped to 1.7%. TCPA and FCRA will have no problem significantly surpassing their 2024 totals, with them ahead by +57.9% and +30.7% respectively.

CFPB complaints barely moved last month, with just a +.9% increase over August, but it is still up +99.5% YTD.

In other news, putative class actions represented 5.1% of FDCPA, 78%(!) of TCPA and 1.4% of FCRA lawsuits filed last month. TCPA class actions are still extraordinarily high, historically speaking. About 45% of all plaintiffs who filed suit last month had filed at least once before. And finally, South Florida attorney Gerald Lane (from The Law Offices of Jibrael S. Hindi) continued for an eighth straight month to represent both the most consumers in August (98) as well as YTD (590).

Complaint Statistics:

28124 consumers filed CFPB complaints, and about 1124 consumers filed lawsuits under consumer statutes from Sep 01, 2025 to Sep 30, 2025.

- 28124 CFPB Complaints

- 428 FDCPA, 22 Class Action (5.1%)

- 287 TCPA, 224 Class Action (78.0%)

- 737 FCRA, 10 Class Action (1.4%)

Litigation Summary (scroll down for CFPB data):

- Of those cases, there were about 1124 unique plaintiffs (including multiple plaintiffs in one suit).

- Of those plaintiffs, about 509, or (45%), had sued under consumer statutes before.

- Combined, those plaintiffs have filed about 6014 lawsuits since 2001

- Actions were filed in 149 different US District Court branches.

- About 723 different collection firms and creditors were sued.

The top courts where lawsuits were filed:

- 99 Lawsuits: California Central District Court – Western Division – Los Angeles

- 76 Lawsuits: Georgia Northern District Court – Atlanta

- 58 Lawsuits: Illinois Northern District Court – Chicago

- 48 Lawsuits: California Central District Court – Eastern Division – Riverside

- 40 Lawsuits: Florida Middle District Court – Tampa

- 40 Lawsuits: Florida Southern District Court – Miami

- 31 Lawsuits: Florida Southern District Court – Fort Lauderdale

- 29 Lawsuits: Texas Northern District Court – Dallas

- 28 Lawsuits: New York Eastern District Court – Brooklyn

- 28 Lawsuits: Pennsylvania Eastern District Court – Philadelphia

The most active consumer attorneys were:

- Representing 98 Consumers: GERALD DONALD LANE

- Representing 18 Consumers: VICTOR ZABALETA

- Representing 17 Consumers: GOR ANTONYAN

- Representing 17 Consumers: ZANE CHARLES HEDAYA

- Representing 16 Consumers: OCTAVIO GOMEZ

- Representing 15 Consumers: JONATHAN ALEXANDER HEEPS

- Representing 13 Consumers: AHREN A TILLER

- Representing 12 Consumers: ANTHONY I PARONICH

- Representing 12 Consumers: ESTHER NNEKA OISE

Statistics Year to Date:

10130 total lawsuits for 2025, including:

- 3246 FDCPA

- 6053 FCRA

- 2128 TCPA

Number of Unique Plaintiffs for 2025: 8515 (including multiple plaintiffs in one suit)

The most active consumer attorneys of the year:

- Representing 590 Consumers: GERALD DONALD LANE

- Representing 209 Consumers: ZANE CHARLES HEDAYA

- Representing 176 Consumers: FAARIS KAMAL UDDIN

- Representing 165 Consumers: OCTAVIO GOMEZ

- Representing 215 Consumers: ANTHONY PARONICH

- Representing 99 Consumers: JONATHAN ALEXANDER HEEPS

- Representing 99 Consumers: DAVID J PHILIPPS

- Representing 99 Consumers: MARK A CAREY

——————————————————————————————————-

CFPB Complaint Statistics:

There were 28124 complaints filed against debt collectors from Sep 01, 2025 to Sep 30, 2025.

Total number of debt collectors complained about: 1097

The types of debt behind the complaints were:

- 16157 I do not know (57%)

- 4507 Other debt (16%)

- 3171 Credit card debt (11%)

- 1437 Auto debt (5%)

- 902 Rental debt (3%)

- 806 Telecommunications debt (3%)

- 686 Medical debt (2%)

- 247 Payday loan debt (1%)

- 85 Federal student loan debt (0%)

- 67 Private student loan debt (0%)

- 59 Mortgage debt (0%)

Here is a breakdown of complaints:

- 10436 Attempts to collect debt not owed (37%)

- 7868 Written notification about debt (28%)

- 4711 Took or threatened to take negative or legal action (17%)

- 3776 False statements or representation (13%)

- 771 Communication tactics (3%)

- 358 Electronic communications (1%)

- 204 Threatened to contact someone or share information improperly (1%)

The top five subissues were:

- 5546 Notification didnt disclose it was an attempt to collect a debt (20%)

- 5222 Debt is not yours (19%)

- 4329 Debt was result of identity theft (15%)

- 4161 Threatened or suggested your credit would be damaged (15%)

- 3573 Attempted to collect wrong amount (13%)

The top states complaints were filed from are:

- 6227 Complaints: TX

- 2782 Complaints: CA

- 2710 Complaints: FL

- 2204 Complaints: GA

- 1260 Complaints: NC

- 1053 Complaints: NY

- 1019 Complaints: IL

- 935 Complaints: PA

- 832 Complaints: VA

- 684 Complaints: AZ

The status of the month’s complaints are as follows:

- 13160 In progress (47%)

- 12182 Closed with explanation (43%)

- 2419 Closed with non-monetary relief (9%)

- 334 Untimely response (1%)

- 29 Closed with monetary relief (0%)

This includes 27612 (98%) timely responses to complaints, and 512 (2%) untimely responses.

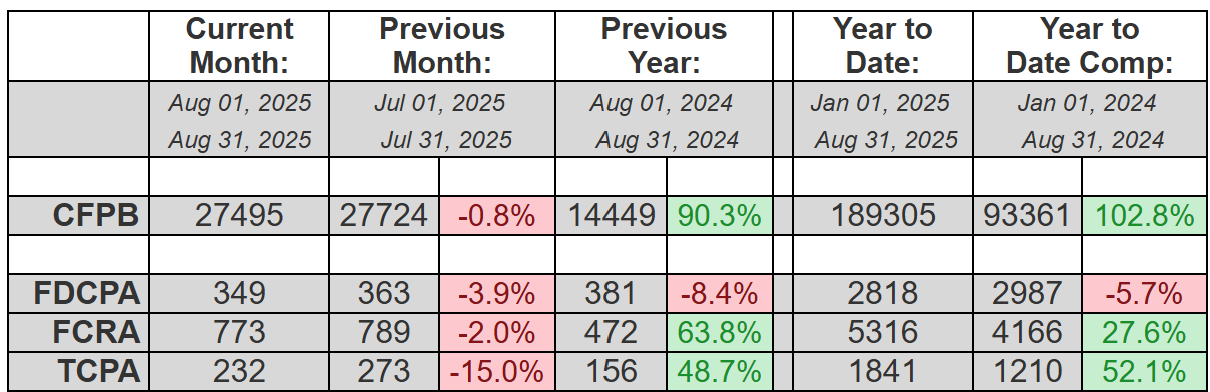

Quick analysis: Everything Down in August; Most Still Up YTD

Similar to April of this year, we are seeing a month where everything dipped for the month, but not enough to change the trajectory of the upward year to date trends.

TCPA (-15%) took the biggest hit, followed by FDCPA (-3.9%) and FCRA (-2%), while CFPB complaints dropped a tiny -.8%.

YTD, however, only FDCPA is still down (-5.7%) while TCPA is still up a lot (-52.1%) followed by FCRA (+27.6%). CFPB complaints are still up over 100% from this time last year, 102.8% to be exact.

In other news, putative class actions represented 3.7% of FDCPA, 69.8%(!) of TCPA and 1.3% of FCRA lawsuits filed last month. TCPA class actions are still extraordinarily high, historically speaking. About 41% of all plaintiffs who filed suit last month had filed at least once before. And finally, South Florida attorney Gerald Lane (from The Law Offices of Jibrael S. Hindi) continued for a seventh straight month to represent both the most consumers in August (53) as well as YTD (492).

Complaint Statistics:

27495 consumers filed CFPB complaints, and about 1134 consumers filed lawsuits under consumer statutes from Aug 01, 2025 to Aug 31, 2025.

- 27495 CFPB Complaints

- 349 FDCPA, 13 Class Action (3.7%)

- 232 TCPA, 162 Class Action (69.8%)

- 773 FCRA, 10 Class Action (1.3%)

Litigation Summary (scroll down for CFPB data):

- Of those cases, there were about 1134 unique plaintiffs (including multiple plaintiffs in one suit).

- Of those plaintiffs, about 465, or (41%), had sued under consumer statutes before.

- Combined, those plaintiffs have filed about 4372 lawsuits since 2001

- Actions were filed in 159 different US District Court branches.

- About 788 different collection firms and creditors were sued.

The top courts where lawsuits were filed:

- 94 Lawsuits: Georgia Northern District Court – Atlanta

- 72 Lawsuits: Illinois Northern District Court – Chicago

- 63 Lawsuits: California Central District Court – Western Division – Los Angeles

- 44 Lawsuits: Florida Middle District Court – Tampa

- 37 Lawsuits: Pennsylvania Eastern District Court – Philadelphia

- 32 Lawsuits: California Central District Court – Southern Division – Santa Ana

- 31 Lawsuits: New Jersey District Court – Newark

- 31 Lawsuits: New York Eastern District Court – Brooklyn

- 30 Lawsuits: Texas Southern District Court – Houston

- 27 Lawsuits: Texas Northern District Court – Dallas

The most active consumer attorneys were:

- Representing 53 Consumers: GERALD DONALD LANE

- Representing 31 Consumers: ANTHONY I PARONICH

- Representing 22 Consumers: MARK A CAREY

- Representing 18 Consumers: OCTAVIO GOMEZ

- Representing 16 Consumers: JEFF LOHMAN

- Representing 12 Consumers: YITZCHAK ZELMAN

- Representing 11 Consumers: MATTHEW THOMAS BERRY

- Representing 11 Consumers: ALUKO COLLINS

Statistics Year to Date:

8864 total lawsuits for 2025, including:

- 2818 FDCPA

- 5316 FCRA

- 1841 TCPA

Number of Unique Plaintiffs for 2025: 7560 (including multiple plaintiffs in one suit)

The most active consumer attorneys of the year:

- Representing 492 Consumers: GERALD DONALD LANE

- Representing 200 Consumers: ANTHONY PARONICH

- Representing 192 Consumers: ZANE CHARLES HEDAYA

- Representing 168 Consumers: FAARIS KAMAL UDDIN

- Representing 149 Consumers: OCTAVIO GOMEZ

- Representing 97 Consumers: MARK A CAREY

- Representing 88 Consumers: DAVID J PHILIPPS

- Representing 86 Consumers: TODD M FRIEDMAN

——————————————————————————————————-

CFPB Complaint Statistics:

There were 27495 complaints filed against debt collectors from Aug 01, 2025 to Aug 31, 2025.

Total number of debt collectors complained about: 1065

The types of debt behind the complaints were:

- 14782 I do not know (54%)

- 5078 Other debt (18%)

- 3289 Credit card debt (12%)

- 1472 Auto debt (5%)

- 903 Telecommunications debt (3%)

- 860 Rental debt (3%)

- 628 Medical debt (2%)

- 238 Payday loan debt (1%)

- 97 Federal student loan debt (0%)

- 84 Private student loan debt (0%)

- 64 Mortgage debt (0%)

Here is a breakdown of complaints:

- 11485 Attempts to collect debt not owed (42%)

- 7379 Written notification about debt (27%)

- 3765 Took or threatened to take negative or legal action (14%)

- 3429 False statements or representation (12%)

- 810 Communication tactics (3%)

- 382 Electronic communications (1%)

- 245 Threatened to contact someone or share information improperly (1%)

The top five subissues were:

- 5813 Debt is not yours (21%)

- 4852 Notification didnt disclose it was an attempt to collect a debt (18%)

- 4732 Debt was result of identity theft (17%)

- 3249 Threatened or suggested your credit would be damaged (12%)

- 3244 Attempted to collect wrong amount (12%)

The top states complaints were filed from are:

- 6402 Complaints: TX

- 2678 Complaints: FL

- 2347 Complaints: CA

- 2100 Complaints: GA

- 1169 Complaints: NC

- 1168 Complaints: NY

- 893 Complaints: IL

- 892 Complaints: VA

- 871 Complaints: PA

- 743 Complaints: NJ

The status of the month’s complaints are as follows:

- 12465 In progress (45%)

- 11692 Closed with explanation (43%)

- 2861 Closed with non-monetary relief (10%)

- 454 Untimely response (2%)

- 23 Closed with monetary relief (0%)

This includes 26717 (97%) timely responses to complaints, and 778 (3%) untimely responses.

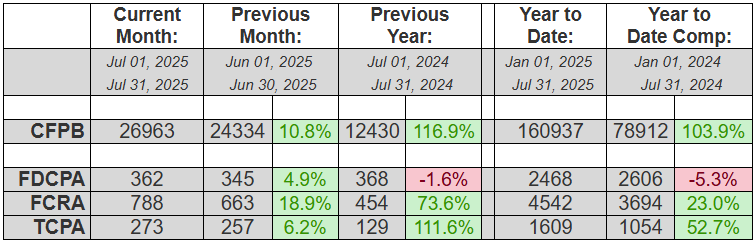

Quick analysis: Everything is back up again

After a dip in most statute filings last month, everything is back up in July.

TCPA (+6.2%), FDCPA (+4.9%) and FCRA (+18.9%(!)) were all up for the month of July. YTD, TCPA (+52.7%) and FCRA (+23%) are both way up, while FDCPA (-5.3%) is the only one still lagging behind last year. But even that margin shrunk (by -.6%) last month, following a months-long pattern of getting smaller.

Meanwhile, CFPB complaints were up 10.8% for the month and up a whopping 103.9%(!) for the year so far.

In other news, putative class actions represented 3.3% of FDCPA, 72.5%(!) of TCPA and 1% of FCRA lawsuits filed last month. TCPA class actions are still extraordinarily high, historically speaking. About 45% of all plaintiffs who filed suit last month had filed at least once before. And finally, South Florida attorney Gerald Lane (from The Law Offices of Jibrael S. Hindi) continued for a sixth straight month to represent both the most consumers in last month (82) as well as YTD (439).

Complaint Statistics:26963 consumers filed CFPB complaints, and about 1131 consumers filed lawsuits under consumer statutes from Jul 01, 2025 to Jul 31, 2025.

- 26963 CFPB Complaints

- 362 FDCPA, 12 Class Action (3.3%)

- 273 TCPA, 198 Class Action (72.5%)

- 788 FCRA, 8 Class Action (1.0%)

Litigation Summary (scroll down for CFPB data):

- Of those cases, there were about 1131 unique plaintiffs (including multiple plaintiffs in one suit).

- Of those plaintiffs, about 508, or (45%), had sued under consumer statutes before.

- Combined, those plaintiffs have filed about 4586 lawsuits since 2001

- Actions were filed in 154 different US District Court branches.

- About 746 different collection firms and creditors were sued.

The top courts where lawsuits were filed:

- 79 Lawsuits: Georgia Northern District Court – Atlanta

- 72 Lawsuits: Florida Middle District Court – Tampa

- 61 Lawsuits: Illinois Northern District Court – Chicago

- 58 Lawsuits: California Central District Court – Western Division – Los Angeles

- 47 Lawsuits: California Central District Court – Southern Division – Santa Ana

- 45 Lawsuits: Florida Southern District Court – Miami

- 35 Lawsuits: California Southern District Court – San Diego

- 30 Lawsuits: Florida Southern District Court – Fort Lauderdale

- 29 Lawsuits: Florida Middle District Court – Orlando

- 27 Lawsuits: California Central District Court – Eastern Division – Riverside

The most active consumer attorneys were:

- Representing 82 Consumers: GERALD DONALD LANE

- Representing 46 Consumers: ZANE CHARLES HEDAYA

- Representing 41 Consumers: FAARIS KAMAL UDDIN

- Representing 23 Consumers: MARK A CAREY

- Representing 18 Consumers: ETHAN BRANDON BABB

- Representing 18 Consumers: SAMANTHA R WOOD

- Representing 17 Consumers: KYLE W SCHUMACHER

- Representing 16 Consumers: ANTHONY PARONICH

- Representing 13 Consumers: JONATHAN H YONG

Statistics Year to Date:

7640 total lawsuits for 2025, including:

- 2468 FDCPA

- 4542 FCRA

- 1609 TCPA

Number of Unique Plaintiffs for 2025: 6567 (including multiple plaintiffs in one suit)The most active consumer attorneys of the year:

- Representing 439 Consumers: GERALD DONALD LANE

- Representing 185 Consumers: ZANE CHARLES HEDAYA

- Representing 164 Consumers: FAARIS KAMAL UDDIN

- Representing 131 Consumers: OCTAVIO GOMEZ

- Representing 99 Consumers: ANTHONY PARONICH

- Representing 77 Consumers: JONATHAN ALEXANDER HEEPS

- Representing 77 Consumers: DAVID J PHILIPPS

- Representing 77 Consumers: TODD M FRIEDMAN

- Representing 75 Consumers: MARK A CAREY

——————————————————————————————————-

CFPB Complaint Statistics:There were 26963 complaints filed against debt collectors from Jul 01, 2025 to Jul 31, 2025.Total number of debt collectors complained about: 1114The types of debt behind the complaints were:

- 14504 I do not know (54%)

- 5191 Other debt (19%)

- 3466 Credit card debt (13%)

- 1008 Rental debt (4%)

- 990 Telecommunications debt (4%)

- 737 Medical debt (3%)

- 568 Auto debt (2%)

- 257 Payday loan debt (1%)

- 104 Federal student loan debt (0%)

- 87 Private student loan debt (0%)

- 51 Mortgage debt (0%)

Here is a breakdown of complaints:

- 11051 Attempts to collect debt not owed (41%)

- 7241 Written notification about debt (27%)

- 3752 False statements or representation (14%)

- 3615 Took or threatened to take negative or legal action (13%)

- 747 Communication tactics (3%)

- 364 Electronic communications (1%)

- 193 Threatened to contact someone or share information improperly (1%)

The top five subissues were:

- 6112 Debt is not yours (23%)

- 4560 Notification didnt disclose it was an attempt to collect a debt (17%)

- 4014 Debt was result of identity theft (15%)

- 3578 Attempted to collect wrong amount (13%)

- 3116 Threatened or suggested your credit would be damaged (12%)

The top states complaints were filed from are:

- 6130 Complaints: TX

- 2938 Complaints: FL

- 2088 Complaints: GA

- 1926 Complaints: CA

- 1254 Complaints: NC

- 1124 Complaints: IL

- 943 Complaints: NY

- 822 Complaints: PA

- 761 Complaints: VA

- 668 Complaints: LA

The status of the month’s complaints are as follows:

- 12629 In progress (47%)

- 11575 Closed with explanation (43%)

- 2432 Closed with non-monetary relief (9%)

- 306 Untimely response (1%)

- 21 Closed with monetary relief (0%)

This includes 26515 (98%) timely responses to complaints, and 448 (2%) untimely responses.

Quick analysis: Full Reversal From May

While May 2023 saw TCPA litigation rise while FDCPA and FCRA litigation both fell, June shows the exact opposite trend.

In June, TCPA (+29.1%) rose while FCRA (-1.2%) and FDCPA (-11.3%) fell. Year to date trends are still on track though, with TCPA (+44.4%) and FCRA (+15.8%) still up from last year and FDCPA (-5.9%) still down. It’s worth noting, however, that the drop in YTD FDCPA claims seems to getting smaller – down from 8-9% over the past few months to that 5.9% we see this month.

Meanwhile, CFPB complaints were down -1.8% for the month but still up 99.4%(!) for the year so far.

In other news, putative class actions represented 6.1% of FDCPA, 78.6%(!) of TCPA and .9% of FCRA lawsuits filed last month. TCPA class actions are still extraordinarily high, historically speaking. About 43% of all plaintiffs who filed suit last month had filed at least once before. And finally, South Florida attorney Gerald Lane (from The Law Offices of Jibrael S. Hindi) continued for a fifth straight month to represent both the most consumers in last month (69) as well as YTD (357).

| Current Month: | Previous Month: | Previous Year: |

Year to Date: | Year to Date Comp: |

|||||

|---|---|---|---|---|---|---|---|---|---|

| Jun 01, 2025 Jun 30, 2025 |

May 01, 2025 May 31, 2025 |

Jun 01, 2024 Jun 30, 2024 |

Jan 01, 2025 Jun 30, 2025 |

Jan 01, 2024 Jun 30, 2024 |

|||||

| CFPB | 23392 | 23794 | -1.7% | 11462 | 104.1% | 132624 | 66482 | 99.5% | |

| FDCPA | 345 | 389 | -11.3% | 302 | 14.2% | 2106 | 2238 | -5.9% | |

| FCRA | 661 | 669 | -1.2% | 496 | 33.3% | 3752 | 3240 | 15.8% | |

| TCPA | 257 | 199 | 29.1% | 151 | 70.2% | 1336 | 925 | 44.4% | |

Complaint Statistics:

23392 consumers filed CFPB complaints, and about 1052 consumers filed lawsuits under consumer statutes from Jun 01, 2025 to Jun 30, 2025.

- 23392 CFPB Complaints

- 345 FDCPA, 21 Class Action (6.1%)

- 257 TCPA, 202 Class Action (78.6%)

- 661 FCRA, 6 Class Action (0.9%)

Litigation Summary (scroll down for CFPB data):

- Of those cases, there were about 1052 unique plaintiffs (including multiple plaintiffs in one suit).

- Of those plaintiffs, about 451, or (43%), had sued under consumer statutes before.

- Combined, those plaintiffs have filed about 4052 lawsuits since 2001

- Actions were filed in 154 different US District Court branches.

- About 606 different collection firms and creditors were sued.

The top courts where lawsuits were filed:

- 98 Lawsuits: Georgia Northern District Court – Atlanta

- 64 Lawsuits: California Central District Court – Western Division – Los Angeles

- 46 Lawsuits: Illinois Northern District Court – Chicago

- 36 Lawsuits: California Central District Court – Southern Division – Santa Ana

- 36 Lawsuits: Florida Middle District Court – Tampa

- 31 Lawsuits: Florida Southern District Court – Fort Lauderdale

- 31 Lawsuits: Michigan Eastern District Court – Detroit

- 30 Lawsuits: New Jersey District Court – Newark

- 29 Lawsuits: Texas Southern District Court – Houston

- 27 Lawsuits: Texas Northern District Court – Dallas

The most active consumer attorneys were:

- Representing 69 Consumers: GERALD DONALD LANE

- Representing 29 Consumers: OCTAVIO GOMEZ

- Representing 25 Consumers: ZANE CHARLES HEDAYA

- Representing 20 Consumers: MARK A CAREY

- Representing 19 Consumers: FAARIS KAMAL UDDIN

- Representing 36 Consumers: ANTHONY I PARONICH

- Representing 15 Consumers: THOMAS JOHN PATTI

- Representing 15 Consumers: JONATHAN H YONG

Statistics Year to Date:

6364 total lawsuits for 2025, including:

- 2106 FDCPA

- 3752 FCRA

- 1336 TCPA

Number of Unique Plaintiffs for 2025: 5591 (including multiple plaintiffs in one suit)

The most active consumer attorneys of the year:

- Representing 357 Consumers: GERALD DONALD LANE

- Representing 139 Consumers: ZANE CHARLES HEDAYA

- Representing 124 Consumers: OCTAVIO GOMEZ

- Representing 123 Consumers: FAARIS KAMAL UDDIN

- Representing 143 Consumers: ANTHONY PARONICH

- Representing 74 Consumers: TODD M FRIEDMAN

- Representing 67 Consumers: JONATHAN ALEXANDER HEEPS

- Representing 66 Consumers: DAVID J PHILIPPS

——————————————————————————————————-

CFPB Complaint Statistics:

There were 23392 complaints filed against debt collectors from Jun 01, 2025 to Jun 30, 2025.

Total number of debt collectors complained about: 1034

The types of debt behind the complaints were:

- 11413 I do not know (49%)

- 4743 Other debt (20%)

- 3509 Credit card debt (15%)

- 1042 Telecommunications debt (4%)

- 926 Rental debt (4%)

- 736 Medical debt (3%)

- 587 Auto debt (3%)

- 192 Payday loan debt (1%)

- 100 Federal student loan debt (0%)

- 82 Private student loan debt (0%)

- 62 Mortgage debt (0%)

Here is a breakdown of complaints:

- 10024 Attempts to collect debt not owed (43%)

- 6908 Written notification about debt (30%)

- 3091 False statements or representation (13%)

- 2143 Took or threatened to take negative or legal action (9%)

- 726 Communication tactics (3%)

- 316 Electronic communications (1%)

- 184 Threatened to contact someone or share information improperly (1%)

The top five subissues were:

- 5378 Debt is not yours (23%)

- 4288 Notification didnt disclose it was an attempt to collect a debt (18%)

- 3638 Debt was result of identity theft (16%)

- 2934 Attempted to collect wrong amount (13%)

- 1660 Threatened or suggested your credit would be damaged (7%)

The top states complaints were filed from are:

- 4892 Complaints: TX

- 2638 Complaints: FL

- 1868 Complaints: GA

- 1674 Complaints: CA

- 957 Complaints: NC

- 897 Complaints: NY

- 805 Complaints: PA

- 718 Complaints: VA

- 694 Complaints: IL

- 583 Complaints: NJ

The status of the month’s complaints are as follows:

- 10893 In progress (47%)

- 9662 Closed with explanation (41%)

- 2421 Closed with non-monetary relief (10%)

- 402 Untimely response (2%)

- 14 Closed with monetary relief (0%)

This includes 22854 (98%) timely responses to complaints, and 538 (2%) untimely responses.

Quick analysis: May ’25 Mostly Up Again

After an across the board decline in April, most of May’s numbers are back up. Only TCPA (-15.3%) suits fell last month while FDCPA (+15.5%) and FCRA (+10.1%) suits were up.

Year to date, TCPA (+39.4%) suits are still up significantly though, as well as FCRA (+12.6%), while FDCPA (-9.1%) suits are the only category that remains down.

Meanwhile, CFPB complaints were up 8.8% for the month and 97.6% for the year so far.

In other news, putative class actions represented 3.4% of FDCPA, 79.9%(!) of TCPA and 1.6% of FCRA lawsuits filed last month. TCPA class actions are still extraordinarily high, historically speaking. About 39% of all plaintiffs who filed suit last month had filed at least once before. And finally, South Florida attorney Gerald Lane (from The Law Offices of Jibrael S. Hindi) continued for a fourth straight month to represent both the most consumers in March (41) as well as YTD (288).

| Current Month: | Previous Month: | Previous Year: |

Year to Date: | Year to Date Comp: |

|||||

|---|---|---|---|---|---|---|---|---|---|

| May 01, 2025 May 31, 2025 |

Apr 01, 2025 Apr 30, 2025 |

May 01, 2024 May 31, 2024 |

Jan 01, 2025 May 31, 2025 |

Jan 01, 2024 May 31, 2024 |

|||||

| CFPB | 23429 | 21528 | 8.8% | 12789 | 83.2% | 108698 | 55020 | 97.6% | |

| FDCPA | 387 | 335 | 15.5% | 445 | -13.0% | 1759 | 1936 | -9.1% | |

| FCRA | 667 | 606 | 10.1% | 546 | 22.2% | 3089 | 2744 | 12.6% | |

| TCPA | 199 | 235 | -15.3% | 163 | 22.1% | 1079 | 774 | 39.4% | |

Complaint Statistics:

23429 consumers filed CFPB complaints, and about 1056 consumers filed lawsuits under consumer statutes from May 01, 2025 to May 31, 2025.

- 23429 CFPB Complaints

- 387 FDCPA, 13 Class Action (3.4%)

- 199 TCPA, 159 Class Action (79.9%)

- 667 FCRA, 11 Class Action (1.6%)

Litigation Summary (scroll down for CFPB data):

- Of those cases, there were about 1056 unique plaintiffs (including multiple plaintiffs in one suit).

- Of those plaintiffs, about 420, or (40%), had sued under consumer statutes before.

- Combined, those plaintiffs have filed about 5012 lawsuits since 2001

- Actions were filed in 164 different US District Court branches.

- About 709 different collection firms and creditors were sued.

The top courts where lawsuits were filed:

- 80 Lawsuits: Georgia Northern District Court – Atlanta

- 60 Lawsuits: Illinois Northern District Court – Chicago

- 53 Lawsuits: California Central District Court – Western Division – Los Angeles

- 45 Lawsuits: Texas Southern District Court – Houston

- 42 Lawsuits: Florida Middle District Court – Tampa

- 33 Lawsuits: Florida Southern District Court – Miami

- 28 Lawsuits: Florida Southern District Court – Fort Lauderdale

- 26 Lawsuits: California Central District Court – Southern Division – Santa Ana

- 25 Lawsuits: Texas Northern District Court – Dallas

- 22 Lawsuits: California Central District Court – Eastern Division – Riverside

The most active consumer attorneys were:

- Representing 41 Consumers: GERALD DONALD LANE

- Representing 23 Consumers: FAARIS KAMAL UDDIN

- Representing 23 Consumers: ZANE CHARLES HEDAYA

- Representing 19 Consumers: JEFF LOHMAN

- Representing 18 Consumers: JOEL S HALVORSEN

- Representing 16 Consumers: ANTHONY PARONICH

- Representing 15 Consumers: OCTAVIO GOMEZ

- Representing 13 Consumers: MATTHEW THOMAS BERRY

- Representing 12 Consumers: JONATHAN ALEXANDER HEEPS

Statistics Year to Date:

5237 total lawsuits for 2025, including:

- 1759 FDCPA

- 3089 FCRA

- 1079 TCPA

Number of Unique Plaintiffs for 2025: 4673 (including multiple plaintiffs in one suit)

The most active consumer attorneys of the year:

- Representing 288 Consumers: GERALD DONALD LANE

- Representing 114 Consumers: ZANE CHARLES HEDAYA

- Representing 104 Consumers: FAARIS KAMAL UDDIN

- Representing 95 Consumers: OCTAVIO GOMEZ

- Representing 67 Consumers: TODD M FRIEDMAN

- Representing 65 Consumers: ANTHONY PARONICH

- Representing 57 Consumers: JONATHAN ALEXANDER HEEPS

- Representing 54 Consumers: DAVID W HEMMINGER

- Representing 53 Consumers: DAVID J PHILIPPS

——————————————————————————————————-

CFPB Complaint Statistics:

There were 23429 complaints filed against debt collectors from May 01, 2025 to May 31, 2025.

Total number of debt collectors complained about: 1017

The types of debt behind the complaints were:

- 11278 I do not know (48%)

- 4782 Other debt (20%)

- 3558 Credit card debt (15%)

- 1116 Telecommunications debt (5%)

- 935 Rental debt (4%)

- 755 Medical debt (3%)

- 540 Auto debt (2%)

- 222 Payday loan debt (1%)

- 98 Federal student loan debt (0%)

- 77 Private student loan debt (0%)

- 68 Mortgage debt (0%)

Here is a breakdown of complaints:

- 9626 Attempts to collect debt not owed (41%)

- 7469 Written notification about debt (32%)

- 3098 False statements or representation (13%)

- 1940 Took or threatened to take negative or legal action (8%)

- 746 Communication tactics (3%)

- 317 Electronic communications (1%)

- 233 Threatened to contact someone or share information improperly (1%)

The top five subissues were:

- 5592 Debt is not yours (24%)

- 4569 Notification didnt disclose it was an attempt to collect a debt (20%)

- 3082 Debt was result of identity theft (13%)

- 2893 Attempted to collect wrong amount (12%)

- 1463 Didnt receive notice of right to dispute (6%)

The top states complaints were filed from are:

- 4938 Complaints: TX

- 2422 Complaints: FL

- 1960 Complaints: GA

- 1534 Complaints: CA

- 1017 Complaints: NY

- 799 Complaints: PA

- 790 Complaints: IL

- 782 Complaints: NC

- 673 Complaints: OH

- 642 Complaints: VA

The status of the month’s complaints are as follows:

- 10397 Closed with explanation (44%)

- 9139 In progress (39%)

- 3390 Closed with non-monetary relief (14%)

- 476 Untimely response (2%)

- 27 Closed with monetary relief (0%)

This includes 22785 (97%) timely responses to complaints, and 644 (3%) untimely responses.

Quick analysis: Everything Down in April, Most Things Up YTD

This was another one of those fun paradoxical months where consumer complaints and litigation in April were all down from March, but most of them (except FDCPA complaints) were still up YTD. Interestingly, the March stats showed everything up for the month, so it’s a complete flip from last month.

For April, everything was down: TCPA (-2.9%), FDCPA (-17.5%), FCRA (-5.6%), and CFPB Complaints (-2.1%). But YTD, we are looking at: TCPA (+44%), FDCPA (-8%), FCRA (+10.2%), and CFPB Complaints (+100.4%)(!)

In other news, putative class actions represented 5.7% of FDCPA, 78.3%(!) of TCPA and 1.2% of FCRA lawsuits filed last month. TCPA class actions are still extraordinarily high, historically speaking. About 41% of all plaintiffs who filed suit last month had filed at least once before. And finally, South Florida attorney Gerald Lane (from The Law Offices of Jibrael S. Hindi) continued for a third straight month to represent both the most consumers in March (46) as well as YTD (247).

| Current Month: | Previous Month: | Previous Year: |

Year to Date: | Year to Date Comp: |

|||||

|---|---|---|---|---|---|---|---|---|---|

| Apr 01, 2025 Apr 30, 2025 |

Mar 01, 2025 Mar 31, 2025 |

Apr 01, 2024 Apr 30, 2024 |

Jan 01, 2025 Apr 30, 2025 |

Jan 01, 2024 Apr 30, 2024 |

|||||

| CFPB | 20915 | 21353 | -2.1% | 13253 | 57.8% | 84610 | 42231 | 100.4% | |

| FDCPA | 335 | 406 | -17.5% | 355 | -5.6% | 1372 | 1491 | -8.0% | |

| FCRA | 606 | 642 | -5.6% | 524 | 15.6% | 2422 | 2198 | 10.2% | |

| TCPA | 235 | 242 | -2.9% | 135 | 74.1% | 880 | 611 | 44.0% | |

Complaint Statistics:

20915 consumers filed CFPB complaints, and about 1006 consumers filed lawsuits under consumer statutes from Apr 01, 2025 to Apr 30, 2025.

- 20915 CFPB Complaints

- 335 FDCPA, 19 Class Action (5.7%)

- 235 TCPA, 184 Class Action (78.3%)

- 606 FCRA, 7 Class Action (1.2%)

Litigation Summary (scroll down for CFPB data):

- Of those cases, there were about 1006 unique plaintiffs (including multiple plaintiffs in one suit).

- Of those plaintiffs, about 415, or (41%), had sued under consumer statutes before.

- Combined, those plaintiffs have filed about 5222 lawsuits since 2001

- Actions were filed in 158 different US District Court branches.

- About 663 different collection firms and creditors were sued.

The top courts where lawsuits were filed:

- 60 Lawsuits: Florida Middle District Court – Tampa

- 59 Lawsuits: Georgia Northern District Court – Atlanta

- 54 Lawsuits: Illinois Northern District Court – Chicago

- 47 Lawsuits: California Central District Court – Western Division – Los Angeles

- 35 Lawsuits: Florida Southern District Court – Miami

- 32 Lawsuits: New York Eastern District Court – Brooklyn

- 28 Lawsuits: Pennsylvania Eastern District Court – Philadelphia

- 28 Lawsuits: Texas Southern District Court – Houston

- 26 Lawsuits: Florida Southern District Court – Fort Lauderdale

- 26 Lawsuits: New York Southern District Court – Foley Square

The most active consumer attorneys were:

- Representing 46 Consumers: GERALD DONALD LANE

- Representing 24 Consumers: ZANE CHARLES HEDAYA

- Representing 20 Consumers: FAARIS KAMAL UDDIN

- Representing 20 Consumers: OCTAVIO GOMEZ

- Representing 16 Consumers: CHRISTOPHER CHAGAS GOLD

- Representing 15 Consumers: TODD M FRIEDMAN

- Representing 13 Consumers: DAVID J PHILIPPS

- Representing 12 Consumers: DAVID W HEMMINGER

- Representing 12 Consumers: ANTHONY PARONICH

Statistics Year to Date:

4137 total lawsuits for 2025, including:

- 1372 FDCPA

- 2422 FCRA

- 880 TCPA

Number of Unique Plaintiffs for 2025: 3721 (including multiple plaintiffs in one suit)

The most active consumer attorneys of the year:

- Representing 247 Consumers: GERALD DONALD LANE

- Representing 91 Consumers: ZANE CHARLES HEDAYA

- Representing 81 Consumers: FAARIS KAMAL UDDIN

- Representing 80 Consumers: OCTAVIO GOMEZ

- Representing 58 Consumers: TODD M FRIEDMAN

- Representing 49 Consumers: ANTHONY PARONICH

- Representing 45 Consumers: DAVID J PHILIPPS

- Representing 45 Consumers: JONATHAN ALEXANDER HEEPS

- Representing 44 Consumers: DAVID W HEMMINGER

——————————————————————————————————-

CFPB Complaint Statistics:

There were 20915 complaints filed against debt collectors from Apr 01, 2025 to Apr 30, 2025.

Total number of debt collectors complained about: 962

The types of debt behind the complaints were:

- 10681 I do not know (51%)

- 3720 Other debt (18%)

- 3046 Credit card debt (15%)

- 953 Telecommunications debt (5%)

- 895 Rental debt (4%)

- 699 Medical debt (3%)

- 498 Auto debt (2%)

- 215 Payday loan debt (1%)

- 80 Federal student loan debt (0%)

- 65 Mortgage debt (0%)

- 63 Private student loan debt (0%)

Here is a breakdown of complaints:

- 9462 Attempts to collect debt not owed (45%)

- 6083 Written notification about debt (29%)

- 2326 False statements or representation (11%)

- 1788 Took or threatened to take negative or legal action (9%)

- 733 Communication tactics (4%)

- 303 Electronic communications (1%)

- 220 Threatened to contact someone or share information improperly (1%)

The top five subissues were:

- 5956 Debt is not yours (28%)

- 4042 Notification didnt disclose it was an attempt to collect a debt (19%)

- 2634 Debt was result of identity theft (13%)

- 2160 Attempted to collect wrong amount (10%)

- 1276 Threatened or suggested your credit would be damaged (6%)

The top states complaints were filed from are:

- 4184 Complaints: TX

- 2415 Complaints: FL

- 1630 Complaints: GA

- 1486 Complaints: CA

- 862 Complaints: IL

- 826 Complaints: NY

- 779 Complaints: PA

- 714 Complaints: NC

- 690 Complaints: VA

- 590 Complaints: MI

The status of the month’s complaints are as follows:

- 9644 Closed with explanation (46%)

- 7165 In progress (34%)

- 3541 Closed with non-monetary relief (17%)

- 539 Untimely response (3%)

- 26 Closed with monetary relief (0%)

This includes 20275 (97%) timely responses to complaints, and 640 (3%) untimely responses.

Quick analysis: Sea of Green (and not the good kind…)

Everything was up in March (TCPA +23.5%, FCRA +5.2%, FDCPA +27.7%) over February, and only FDCPA (-8.7%) was down YTD over 2023, while TCPA (+35.5%) and FCRA (+8.5%) were also up YTD. Welcome to spring!

CFPB complaints were also up for the month (+16%) and the year (+116.4%!)

In other news, putative class actions represented 5.9% of FDCPA, 77.3%(!) of TCPA and 2.3% of FCRA lawsuits filed last month. TCPA class actions are still extraordinarily high, historically speaking. About 40% of all plaintiffs who filed suit last month had filed at least once before. And finally, South Florida attorney Gerald Lane (from The Law Offices of Jibrael S. Hindi) continued for a second month to represent both the most consumers in Feb (90) as well as YTD (203).

| Current Month: | Previous Month: | Previous Year: |

Year to Date: | Year to Date Comp: |

|||||

|---|---|---|---|---|---|---|---|---|---|

| Mar 01, 2025 Mar 31, 2025 |

Feb 01, 2025 Feb 28, 2025 |

Mar 01, 2024 Mar 31, 2024 |

Jan 01, 2025 Mar 31, 2025 |

Jan 01, 2024 Mar 31, 2024 |

|||||

| CFPB | 20485 | 17653 | 16.0% | 12693 | 61.4% | 62707 | 28978 | 116.4% | |

| FDCPA | 406 | 318 | 27.7% | 315 | 28.9% | 1037 | 1136 | -8.7% | |

| FCRA | 642 | 610 | 5.2% | 465 | 38.1% | 1816 | 1674 | 8.5% | |

| TCPA | 242 | 196 | 23.5% | 139 | 74.1% | 645 | 476 | 35.5% | |

Complaint Statistics:

20485 consumers filed CFPB complaints, and about 1053 consumers filed lawsuits under consumer statutes from Mar 01, 2025 to Mar 31, 2025.

- 20485 CFPB Complaints

- 406 FDCPA, 24 Class Action (5.9%)

- 242 TCPA, 187 Class Action (77.3%)

- 642 FCRA, 15 Class Action (2.3%)

Litigation Summary (scroll down for CFPB data):

- Of those cases, there were about 1053 unique plaintiffs (including multiple plaintiffs in one suit).

- Of those plaintiffs, about 425, or (40%), had sued under consumer statutes before.

- Combined, those plaintiffs have filed about 3224 lawsuits since 2001

- Actions were filed in 145 different US District Court branches.

- About 680 different collection firms and creditors were sued.

The top courts where lawsuits were filed:

- 100 Lawsuits: Georgia Northern District Court – Atlanta

- 75 Lawsuits: California Central District Court – Western Division – Los Angeles

- 74 Lawsuits: Illinois Northern District Court – Chicago

- 43 Lawsuits: Florida Middle District Court – Tampa

- 34 Lawsuits: Nevada District Court – Las Vegas

- 33 Lawsuits: California Central District Court – Eastern Division – Riverside

- 28 Lawsuits: Pennsylvania Eastern District Court – Philadelphia

- 26 Lawsuits: California Central District Court – Southern Division – Santa Ana

- 26 Lawsuits: California Southern District Court – San Diego

- 26 Lawsuits: Indiana Southern District Court – Indianapolis

The most active consumer attorneys were:

- Representing 90 Consumers: GERALD DONALD LANE

- Representing 35 Consumers: OCTAVIO GOMEZ

- Representing 23 Consumers: TODD M FRIEDMAN

- Representing 22 Consumers: MICHAEL KIND

- Representing 21 Consumers: ZANE CHARLES HEDAYA

- Representing 20 Consumers: JEFF LOHMAN

- Representing 20 Consumers: MATTHEW TRIPP-COX

- Representing 19 Consumers: FAARIS KAMAL UDDIN

- Representing 17 Consumers: YITZCHAK ZELMAN

Statistics Year to Date:

3089 total lawsuits for 2025, including:

- 1037 FDCPA

- 1816 FCRA

- 645 TCPA

Number of Unique Plaintiffs for 2025: 2806 (including multiple plaintiffs in one suit)

The most active consumer attorneys of the year:

- Representing 203 Consumers: GERALD D LANE

- Representing 67 Consumers: ZANE CHARLES HEDAYA

- Representing 61 Consumers: FAARIS KAMAL UDDIN

- Representing 60 Consumers: OCTAVIO GOMEZ

- Representing 43 Consumers: TODD M FRIEDMAN

- Representing 37 Consumers: ANTHONY PARONICH

- Representing 35 Consumers: GERARDO AVALOS

- Representing 35 Consumers: GEORGE HAINES

- Representing 34 Consumers: JONATHAN ALEXANDER HEEPS

——————————————————————————————————-

CFPB Complaint Statistics:

There were 20485 complaints filed against debt collectors from Mar 01, 2025 to Mar 31, 2025.

Total number of debt collectors complained about: 996

The types of debt behind the complaints were:

- 11850 I do not know (58%)

- 2916 Credit card debt (14%)

- 2453 Other debt (12%)

- 892 Telecommunications debt (4%)

- 792 Rental debt (4%)

- 679 Medical debt (3%)

- 490 Auto debt (2%)

- 198 Payday loan debt (1%)

- 82 Federal student loan debt (0%)

- 78 Private student loan debt (0%)

- 55 Mortgage debt (0%)

Here is a breakdown of complaints:

- 9231 Attempts to collect debt not owed (45%)

- 4567 Written notification about debt (22%)

- 3252 False statements or representation (16%)

- 2183 Took or threatened to take negative or legal action (11%)

- 744 Communication tactics (4%)

- 317 Electronic communications (2%)

- 191 Threatened to contact someone or share information improperly (1%)

The top five subissues were:

- 5969 Debt is not yours (29%)

- 3042 Attempted to collect wrong amount (15%)

- 2426 Debt was result of identity theft (12%)

- 2410 Notification didnt disclose it was an attempt to collect a debt (12%)

- 1467 Didnt receive enough information to verify debt (7%)

The top states complaints were filed from are:

- 3479 Complaints: TX

- 2555 Complaints: FL

- 1848 Complaints: GA

- 1391 Complaints: CA

- 932 Complaints: NY

- 867 Complaints: IL

- 843 Complaints: PA

- 595 Complaints: NC

- 544 Complaints: NJ

- 544 Complaints: MI

The status of the month’s complaints are as follows:

- 9567 Closed with explanation (47%)

- 8473 In progress (41%)

- 2295 Closed with non-monetary relief (11%)

- 129 Untimely response (1%)

- 21 Closed with monetary relief (0%)

This includes 20242 (99%) timely responses to complaints, and 243 (1%) untimely responses.

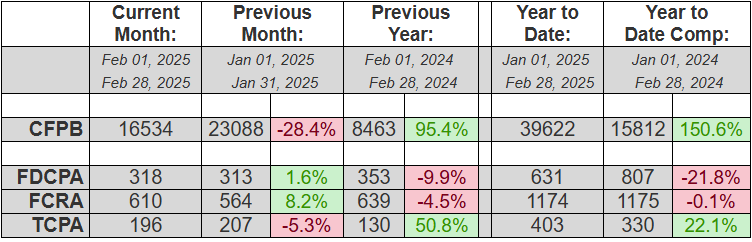

Quick analysis: Apologies for the short hiatus, but we’re back now!

February lawsuits were pretty mixed. FDCPA (+1.6%) and FCRA (+8.2%) were both up a bit, while TCPA (-5.3%) was down a bit.

YTD, however, is actually the opposite. FDCPA (-21.8%) and FCRA (-0.1%) are both down, while TCPA (+22.1%) is off to a busy start. Lots of wild swings in there!

Continuing last year’s trend, CFPB complaints are still going strong. They are down -28.4% for Feb but still up 150% YTD, which goes to show how volatile the numbers can be in this era of uncertainty.

In other news, putative class actions represented 4.1% of FDCPA, 75.5%(!) of TCPA and 1% of FCRA lawsuits filed last month. TCPA class actions are still extraordinarily high, historically speaking. About 40% of all plaintiffs who filed suit last month had filed at least once before. And finally, South Florida attorney Gerald Lane (from The Law Offices of Jibrael S. Hindi) represented both the most consumers in Feb (57) as well as YTD (113).

Complaint Statistics:

16534 consumers filed CFPB complaints, and about 926 consumers filed lawsuits under consumer statutes from Feb 01, 2025 to Feb 28, 2025.

- 16534 CFPB Complaints

- 318 FDCPA, 13 Class Action (4.1%)

- 196 TCPA, 148 Class Action (75.5%)

- 610 FCRA, 6 Class Action (1.0%)

Litigation Summary (scroll down for CFPB data):

- Of those cases, there were about 926 unique plaintiffs (including multiple plaintiffs in one suit).

- Of those plaintiffs, about 374, or (40%), had sued under consumer statutes before.

- Combined, those plaintiffs have filed about 4510 lawsuits since 2001

- Actions were filed in 140 different US District Court branches.

- About 604 different collection firms and creditors were sued.

The top courts where lawsuits were filed:

- 69 Lawsuits: Georgia Northern District Court – Atlanta

- 59 Lawsuits: California Central District Court – Western Division – Los Angeles

- 39 Lawsuits: Florida Middle District Court – Tampa

- 35 Lawsuits: Illinois Northern District Court – Chicago

- 25 Lawsuits: Florida Southern District Court – Miami

- 25 Lawsuits: Texas Southern District Court – Houston

- 24 Lawsuits: Florida Middle District Court – Orlando

- 23 Lawsuits: California Central District Court – Eastern Division – Riverside

- 23 Lawsuits: New York Eastern District Court – Brooklyn

- 21 Lawsuits: California Central District Court – Southern Division – Santa Ana

The most active consumer attorneys were:

- Representing 57 Consumers: GERALD DONALD LANE

- Representing 24 Consumers: ZANE CHARLES HEDAYA

- Representing 18 Consumers: FAARIS KAMAL UDDIN

- Representing 16 Consumers: GERARDO AVALOS

- Representing 16 Consumers: GEORGE HAINES

- Representing 15 Consumers: MARK A CAREY

- Representing 13 Consumers: JOHN JUSTIN MARAVALLI

- Representing 12 Consumers: MERRICK B WILLIAMS

- Representing 12 Consumers: NICHOLAS J BONTRAGER

Statistics Year to Date:

1968 total lawsuits for 2025, including:

- 631 FDCPA

- 1174 FCRA

- 403 TCPA

Number of Unique Plaintiffs for 2025: 1818 (including multiple plaintiffs in one suit)

The most active consumer attorneys of the year:

- Representing 113 Consumers: GERALD DONALD LANE

- Representing 46 Consumers: ZANE CHARLES HEDAYA

- Representing 42 Consumers: FAARIS KAMAL UDDIN

- Representing 30 Consumers: GERARDO AVALOS

- Representing 30 Consumers: GEORGE HAINES

- Representing 29 Consumers: ANTHONY PARONICH

- Representing 25 Consumers: OCTAVIO GOMEZ

- Representing 24 Consumers: DAVID W HEMMINGER

- Representing 22 Consumers: MERRICK B WILLIAMS

——————————————————————————————————-

CFPB Complaint Statistics:

There were 16534 complaints filed against debt collectors from Feb 01, 2025 to Feb 28, 2025.

Total number of debt collectors complained about: 942

The types of debt behind the complaints were:

- 8959 I do not know (54%)

- 2645 Credit card debt (16%)

- 1827 Other debt (11%)

- 821 Rental debt (5%)

- 797 Telecommunications debt (5%)

- 641 Medical debt (4%)

- 470 Auto debt (3%)

- 188 Payday loan debt (1%)

- 76 Private student loan debt (0%)

- 60 Mortgage debt (0%)

- 50 Federal student loan debt (0%)

Here is a breakdown of complaints:

- 8453 Attempts to collect debt not owed (51%)

- 3365 Written notification about debt (20%)

- 1878 False statements or representation (11%)

- 1787 Took or threatened to take negative or legal action (11%)

- 666 Communication tactics (4%)

- 235 Electronic communications (1%)

- 150 Threatened to contact someone or share information improperly (1%)

The top five subissues were:

- 5016 Debt is not yours (30%)

- 2472 Debt was result of identity theft (15%)

- 1700 Attempted to collect wrong amount (10%)

- 1432 Notification didnt disclose it was an attempt to collect a debt (9%)

- 1284 Didnt receive enough information to verify debt (8%)

The top states complaints were filed from are:

- 2844 Complaints: TX

- 1899 Complaints: FL

- 1405 Complaints: GA

- 1130 Complaints: CA

- 703 Complaints: PA

- 689 Complaints: IL

- 647 Complaints: NY

- 572 Complaints: NC

- 501 Complaints: OH

- 484 Complaints: MI

The status of the month’s complaints are as follows:

- 8495 Closed with explanation (51%)

- 5835 In progress (35%)

- 2094 Closed with non-monetary relief (13%)

- 87 Untimely response (1%)

- 23 Closed with monetary relief (0%)

This includes 16322 (99%) timely responses to complaints, and 212 (1%) untimely responses.

Quick analysis:

| Current Month: | Previous Month: | Previous Year: |

Year to Date: | Year to Date Comp: |

|||||

|---|---|---|---|---|---|---|---|---|---|

| Jan 01, 2025 Jan 31, 2025 |

Dec 01, 2024 Dec 31, 2024 |

Jan 01, 2024 Jan 31, 2024 |

Jan 01, 2025 Jan 31, 2025 |

Jan 01, 2024 Jan 31, 2024 |

|||||

| CFPB | 22347 | 16587 | 34.7% | 7349 | 204.1% | 22347 | 7349 | 204.1% | |

| FDCPA | 311 | 289 | 7.6% | 454 | -31.5% | 311 | 454 | -31.5% | |

| FCRA | 564 | 542 | 4.1% | 536 | 5.2% | 564 | 536 | 5.2% | |

| TCPA | 207 | 191 | 8.4% | 200 | 3.5% | 207 | 200 | 3.5% | |

Complaint Statistics:

22347 consumers filed CFPB complaints, and about 939 consumers filed lawsuits under consumer statutes from Jan 01, 2025 to Jan 31, 2025.

- 22347 CFPB Complaints

- 311 FDCPA, 12 Class Action (3.9%)

- 207 TCPA, 172 Class Action (83.1%)

- 564 FCRA, 11 Class Action (2.0%)

Litigation Summary (scroll down for CFPB data):

- Of those cases, there were about 939 unique plaintiffs (including multiple plaintiffs in one suit).

- Of those plaintiffs, about 393, or (42%), had sued under consumer statutes before.

- Combined, those plaintiffs have filed about 7409 lawsuits since 2001

- Actions were filed in 147 different US District Court branches.

- About 633 different collection firms and creditors were sued.

The top courts where lawsuits were filed:

- 58 Lawsuits: Georgia Northern District Court – Atlanta

- 57 Lawsuits: California Central District Court – Western Division – Los Angeles

- 51 Lawsuits: Florida Middle District Court – Tampa

- 44 Lawsuits: Illinois Northern District Court – Chicago

- 30 Lawsuits: Indiana Southern District Court – Indianapolis

- 29 Lawsuits: California Central District Court – Eastern Division – Riverside

- 26 Lawsuits: Florida Southern District Court – Miami

- 26 Lawsuits: Texas Southern District Court – Houston

- 25 Lawsuits: Nevada District Court – Las Vegas

- 25 Lawsuits: New York Eastern District Court – Brooklyn

The most active consumer attorneys were:

- Representing 40 Consumers: GERALD DONALD LANE

- Representing 24 Consumers: FAARIS KAMAL UDDIN

- Representing 22 Consumers: ZANE CHARLES HEDAYA

- Representing 19 Consumers: ANTHONY PARONICH

- Representing 18 Consumers: OCTAVIO GOMEZ

- Representing 16 Consumers: GERALD D LANE

- Representing 14 Consumers: GERARDO AVALOS

- Representing 14 Consumers: GEORGE HAINES

- Representing 13 Consumers: DAVID W HEMMINGER

- Representing 12 Consumers: JONATHAN ALEXANDER HEEPS

Statistics Year to Date:

982 total lawsuits for 2025, including:

- 311 FDCPA

- 564 FCRA

- 207 TCPA

Number of Unique Plaintiffs for 2025: 939 (including multiple plaintiffs in one suit)

The most active consumer attorneys of the year:

- Representing 40 Consumers: GERALD DONALD LANE

- Representing 24 Consumers: FAARIS KAMAL UDDIN

- Representing 22 Consumers: ZANE CHARLES HEDAYA

- Representing 19 Consumers: ANTHONY PARONICH

- Representing 18 Consumers: OCTAVIO GOMEZ

- Representing 16 Consumers: GERALD D LANE

- Representing 14 Consumers: GERARDO AVALOS

- Representing 14 Consumers: GEORGE HAINES

- Representing 13 Consumers: DAVID W HEMMINGER

- Representing 12 Consumers: JONATHAN ALEXANDER HEEPS

——————————————————————————————————-

CFPB Complaint Statistics:

There were 22347 complaints filed against debt collectors from Jan 01, 2025 to Jan 31, 2025.

Total number of debt collectors complained about: 1037

The types of debt behind the complaints were:

- 11296 I do not know (51%)

- 3693 Credit card debt (17%)

- 3234 Other debt (14%)

- 1056 Rental debt (5%)

- 1019 Telecommunications debt (5%)

- 881 Medical debt (4%)

- 715 Auto debt (3%)

- 252 Payday loan debt (1%)

- 78 Private student loan debt (0%)

- 62 Mortgage debt (0%)

- 61 Federal student loan debt (0%)

Here is a breakdown of complaints:

- 9797 Attempts to collect debt not owed (44%)

- 5130 Written notification about debt (23%)

- 3626 False statements or representation (16%)

- 2245 Took or threatened to take negative or legal action (10%)

- 932 Communication tactics (4%)

- 381 Electronic communications (2%)

- 236 Threatened to contact someone or share information improperly (1%)

The top five subissues were:

- 5675 Debt is not yours (25%)

- 3407 Attempted to collect wrong amount (15%)

- 3020 Debt was result of identity theft (14%)

- 2478 Notification didnt disclose it was an attempt to collect a debt (11%)

- 1682 Didnt receive enough information to verify debt (8%)

The top states complaints were filed from are:

- 4028 Complaints: TX

- 2486 Complaints: FL

- 2000 Complaints: GA

- 1566 Complaints: CA

- 968 Complaints: NY

- 906 Complaints: IL

- 827 Complaints: PA

- 777 Complaints: NC

- 646 Complaints: OH

- 609 Complaints: MI

The status of the month’s complaints are as follows:

- 10896 Closed with explanation (49%)

- 8204 In progress (37%)

- 3100 Closed with non-monetary relief (14%)

- 112 Untimely response (1%)

- 35 Closed with monetary relief (0%)

This includes 22090 (99%) timely responses to complaints, and 257 (1%) untimely responses.